Start gambling enterprise position just after evening drops Ports Zero-put Added bonus 2025 $one hundred Free Processor chip

Alles Spitze sofort gratis & goddess of life Slot -Spiel exklusive Anmeldung vortragen

13 mei 2025Alles Vorhut Merkur Slot erreichbar unter einsatz von Echtgeld zum freie Spins auf anaconda eye besten geben

13 mei 2025Posts

The new Ca Agency away from Economic Defense and Invention (CDFPI) closed SVB for the day of March ten and you may designated the fresh FDIC as the recipient. One way to consider this to be the new Given-provided funding, following, is really as an alternative of your own financing from the depositors prior to the brand new financial stress. The bottom line is, depositors’ money diminished and is actually changed because of the investment regarding the FHLBs and also the Given. These types of resources of money is actually, in principle, much more firmly attached to the level of industry rates of interest and like that diluted the benefit you to definitely banking companies had been thought of to help you provides since the rates of interest changed and you can core dumps have been slow to help you reprice. Which have 2023 started, a little more about depositors realized there are really attractive rates of interest designed for investing money in industry.

Bask Financial

SVB served as the a primary financial to own promotion-recognized organizations already enduring high interest levels and you may an excellent dwindling marketplace for very first public choices, limiting their capability to improve bucks. Seiberg opposed SVB for the failure away from crypto-focused Silvergate Financing, which announced to your Wednesday that it’ll power down operations and liquidate the lender. SVB are greatly focused on the fresh technical and you can venture capital room, which had been flooded that have attention through the 2021. Silvergate’s shares skyrocketed you to definitely year, from a similar hurry for the cryptocurrencies and you can speculative assets. But as the people feared Silicone polymer Area Bank’s difficulties perform lead to contagion, they ordered ties.

USAA FSB will pay $382,five hundred flooding insurance rates punishment

Come across Book 590-A for particular conditions that can get allow you to prevent and withdrawals away from an excessive amount of benefits in your gross income. This website also provides commentary, study and investigation from your economists and you will pros. Viewpoints conveyed aren’t always the ones from the newest St. Louis Fed or Government Set aside Program. Already, the best cost be seemingly to have half a dozen-day, nine- otherwise 10-day plus one-season Cds, hanging from the 5% APY or just less than.

As a result, this type of depositors was surprisingly competent during the and accustomed to moving finance very quickly. This type of depositors had and experienced large volatility inside crypto-resource segments during the 2022, for instance the failure of FTX within the Late. 2022, having caused these to getting such as responsive to signs away from monetary problems and you may quick to react. That it quote demonstrates depositors from the Silvergate likely got particular sense of each and every someone else’ tips because they you may observe if or not most other counterparties continued to accomplish company to the Silvergate’s payment network. In contrast, more severe focus on has just is at Silicone Valley Bank, and that lost twenty five% of the dumps in a day and you may are signed just before an enthusiastic a lot more 62% is arranged to help you circulate from the 2nd.

It murky image and President Trump’s tariff regulations, that will likely be inflationary, guides me to welcome merely modest rate of interest incisions later inside the the year. A fund happy-gambler.com hop over to the web site business membership try a fair location to keep your short-term supplies as we assume interest levels to be fairly constant. Yet not, to have larger cash holdings, savers should split up their money anywhere between an excellent Cd and you may a fund market account to protect large cost.

Signature Lender in addition to got a good $34 billion commercial and you can commercial mortgage profile; $28 billion of those have been finance made through the Fund Financial Department, and therefore given money to private collateral businesses in addition to their standard lovers. Instead of SVB, which shown depreciation within its complete securities portfolio away from 104 per cent to help you full money, Signature Financial’s quantity of decline is up to 30 percent. More serious of the operates indexed just before 2022 is actually Continental’s, between the loss of 31% of the funding in the ten days. Multiple extra reduced banks knowledgeable runs inside the 2008, along with National Area, Sovereign, and you can IndyMac because the revealed by Rose (2015). It would appear that technological improvements can also be explain some of the raise in the price, however, large increases in the speed most likely simply affect family and you will small company depositors. Biggest firms, which have been the brand new widespread supply of deposit distributions inside the previous work on attacks in the largest banks, currently were able to withdraw fund inside the an automated digital trend since the later seventies.

greatest Video game rates of Can get 2025: To cuatro.40% APY

Ones students help their parents, 45% said these people were permitting having hunting, 43% which have utility bills and you can twenty six% which have mortgage payments. Not a bank from The united kingdomt interest rate slash assisted boost non-financial holds, while the the lending company went on to help you struck a cautious build to the the fresh candidates for further decrease. “This is exactly why we’re carried on to provide totally free-diversity products and starting barn egg included in our lingering try to offer various highest hobbies possibilities from the cost anyone are able.” A representative for Iceland told you it was “completely purchased creature interests as well as so you can securing the customers in the lingering costs-of-life drama”. Almost two-thirds (62%) away from respondents told you these people were expected to offer the same suggestions two to three moments.

It isn’t so excellent for those who open a merchant account after the Government Set aside slashes interest levels. Very early lead deposit form an early salary, yet not all banking institutions offer this service. Uninsured depositors interpreted SVBFG’s announcements to your February 8 as the a rule you to SVBFG was at economic distress and began withdrawing places to the March 9, when SVB educated a complete put outflow more than $40 billion.

“It’s the last CPI report through to the Provided meeting, and that i believe that would be a switch business mover and you will set the newest tone to the market and volatility in a few days,” said Michael Arone, captain funding strategist during the Condition Highway International Advisers. Arone anticipates the brand new Fed to raise cost by the a-quarter part, but a scorching number you’ll raise criterion to have an one half commission point hike. Since the SVB are shorter determined by merchandising places versus an excellent traditional bank, Seiberg said the financial institution try far more confronted with interest rate exposure as the funding got more costly, but the property were not expanding in cost.

Has just, I found myself chose Treasurer of the Neighborhood from Elite group Journalists’ SDX Foundation (Arizona, DC part), increasing grant money for aspiring young reporters. CFG Bank’s Highest Produce Money Market membership earns an incredibly competitive APY, whilst you’ll only secure desire to your part of what you owe higher than just $step one,000. You’ll in addition need at the very least $step 1,000 to open up the fresh account, and you will maintaining a reduced every day equilibrium results in a good $ten monthly provider percentage.

Are there complications with early direct deposit?

Fidelity usually do not make certain that everything here are exact, complete, or prompt. Fidelity makes zero warranties for including advice otherwise results gotten by the its have fun with, and you may disclaims one accountability developing out of your access to, or people taxation condition drawn in reliance upon, for example guidance. Consult a lawyer otherwise tax elite about your particular condition. The tip is always to seek to rescue at the least 15% of the income each year (as well as people workplace benefits) to possess senior years.

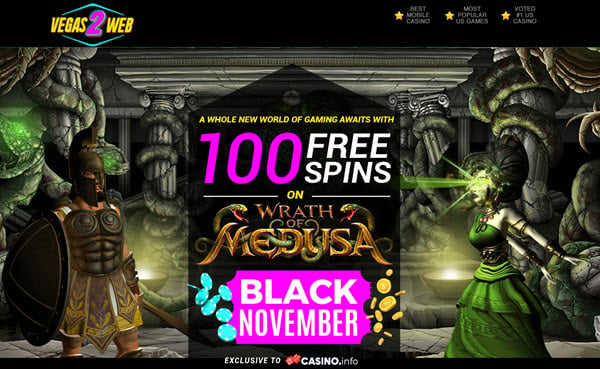

Even though you can find exemplary images and you may unique features, so it position video game will likely be starred on the cellular or pill things round the several networks. The video game’s results will be based upon the team’s scrutiny and they attempt the online game to the Android and apple’s ios products. Regarding wagers, you have to know your slot begins with a default choice out of $step 3. By the way, don’t forget to with ease change the bet for every range, coin size, and complete paylines to help you bet regarding the pursuing the range – from $0.02 around $150 for each twist.